Are you looking for a payment processing solution for your salon or spa?

Then you’ve landed in the right place.

Accepting a variety of payment options suited to your clients is essential. Many merchant services could meet your business needs.

But which one is the best fit?

This guide compares the top integrated credit card and payment processing systems built specifically for salons and spas.

Beyond processing transactions, these feature-rich solutions provide value-adds like point-of-sale (POS) and appointment management.

Read on for an overview of the top 7 salon payment systems to help you select the ideal option for your business.

Quick Overview of The Best Salon Payment Systems 2025

Below is an overview of the top 7 salon payment systems in 2025. Platform differences mean the optimal solution depends on the size of your business and distinct needs. So, consider reviewing the full list before selecting the best choice.

Let’s Double-Click on Each Salon Payment System Alternative

We have used and thoroughly researched each salon software platform listed here. This section aims to provide our overall evaluation and impressions to help narrow your choices. For more details about each system, see the dedicated system reviews I’m linking here.

Mangomint: The Highest-Rated Salon & Spa Software with Integrated POS & Credit Card Processor (US & Canada)

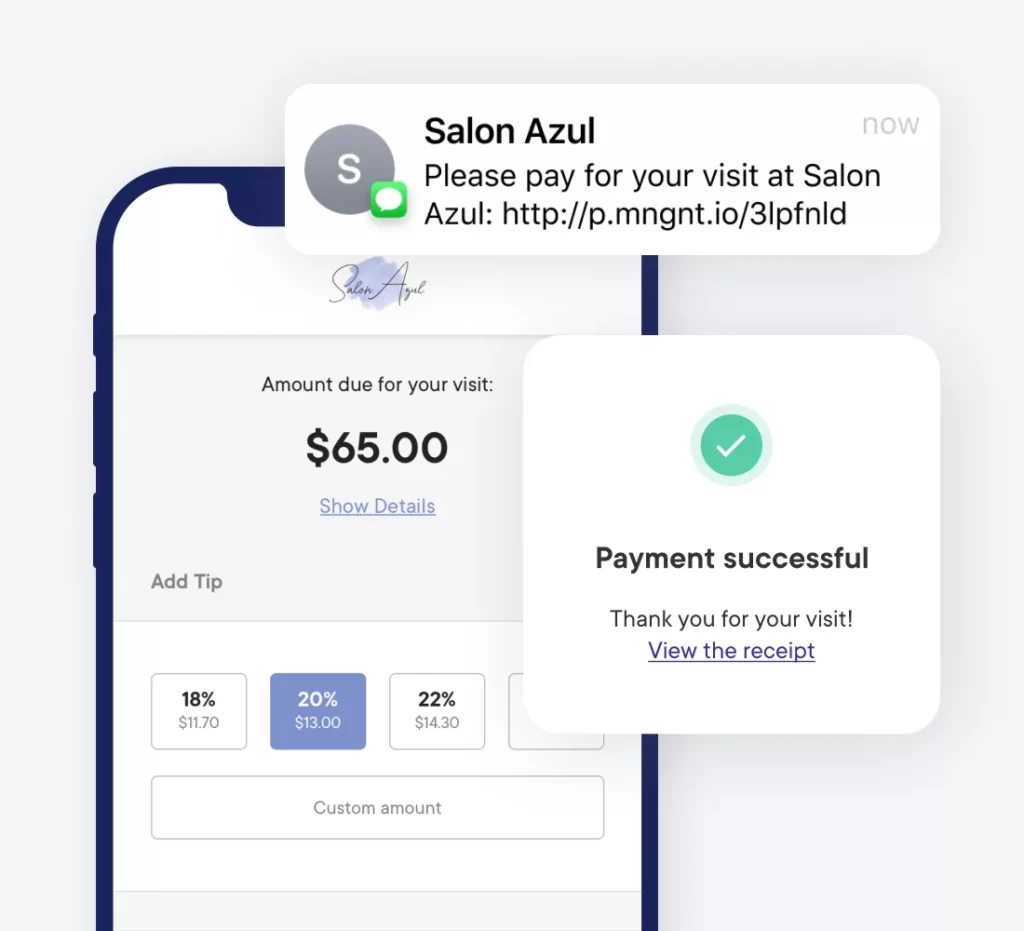

Mangomint is the most modern and well-designed salon and spa software with smart features to help you streamline administrative tasks while improving the payment experience.

This platform is designed for the salon or spa with a team that requires sophisticated features and a five-star client experience. Payments are integrated into the platform and work seamlessly with appointments, POS, inventory, and business reporting.

There are a few payment features that I find particularly interesting that you wouldn’t find with other platforms.

One example of this is the Express Booking™ feature. It solves the pain of collecting email addresses, credit card information, deposits, and cancellation policy consent over the phone. Instead, you can accept the appointment via phone or in person and then just send a text with a link where they can complete their booking.

Another powerful feature is that you can connect multiple merchant accounts to Mangomint. This can greatly help businesses with booth renters or other complex structures. When you have independent professionals working inside your business, you want to ensure payments are routed to the right place.

You can also store clients’ credit card details on file and charge recurring payments if you offer a service subscription or membership.

The Mangomint Card Reader

Mangomint offers a compact Bluetooth card processor and Front Desk Display that turns your iPad into a client-facing screen where clients can pay and choose to leave a tip.

Mangomint Pricing

At first sight, Mangomint may look expensive compared to the other options.

But if you run a bigger business with a team and look at the cost per employee and the time savings that are possible with Mangomint, it is not expensive. The cost per card transaction is also low. Something that would be important to a bigger business that processes a large amount of transactions.

- Free 30-day trial (60-day free trial if you sign up using this link)

- Entry level plan starts at $165/ month (supports 10 service providers) and goes up to $375 for their Unlimited plan

- In-person transactions: 2.45% + 15¢

- Virtual transactions: 2.9% + 20¢

- One card reader is included for free in their standard plan. Additional card readers cost $100/ device.

Pros

- Modern, easy-to-use, interface

- Smart automations that help cut down on time spent managing business operations

- Open data ownership and contracts (you’re not locked into anything)

- Can integrate with any other platform that allows for integrations

- Memberships, packages, gift cards

- Forms, two-way client texting, waiting room management, intelligent waitlist, and many other smart features

- Sophisticated reports

- Strong and personal customer service & help documentation

Cons

- Higher entry-level price than some other salon software options

In summary, I recommend Mangomint if you run a bigger salon or spa and want a complete, well-designed business management system to help simplify your operations.

Read my full review of Mangomint here.

Special offer: Get 2 months of Mangomint for free when you sign up via the link below.

GlossGenius: The Salon POS & Credit Card Reader for Independent Professionals

GlossGenius is an all-in-one payment, appointment, and marketing app for independent professionals in the USA.

Here, you can manage your entire business with an easy-to-use, beautifully designed app.

Everything about GlossGenius breathes exceptional beauty. Even the card reader is designed for a high-end client experience. And it’s the combination of excellent design and simplicity that makes this tool truly unique.

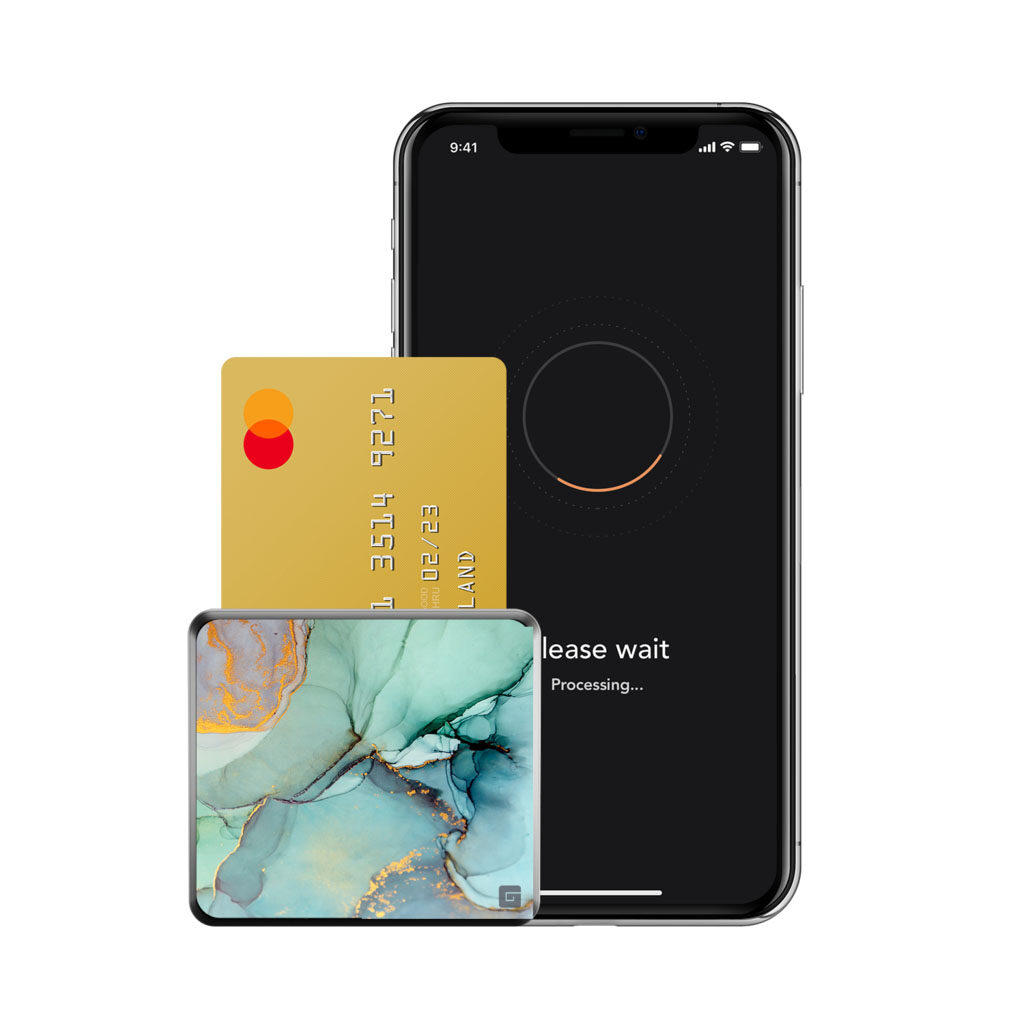

The GlossGenius Card Reader

The credit card reader allows you to check out your customers in style. The reader itself comes in a wide variety of designs that you can explore at the GlossGenius Website.

It connects via Bluetooth directly to your phone and the app. The reader accepts all payment types, including contactless payments. The cost per credit card swipe is 2.6%.

GlossGenius is a great alternative for the independent professional or small salon looking for a beautifully designed and intuitive credit card reader at a low monthly fee.

GlossGenius is only available in the US (at the moment).

GlossGenius Credit Card Fees and Pricing

GlossGenius has one flat fee plan at $24/month. Regardless of your team size, that’s what you pay for all the features.

- Free 14-day trial

- $24/month standard plan (unlimited employees)

- 2.6% per credit card transaction fee

- The credit card reader is $49

Pros

- Affordable and transparent flat-fee pricing

- Beautiful design

- Multiple card reader design options to fit your brand

- Fully integrated with salon appointments and client data

Cons

- Limited flexibility (you need to use the built-in format)

- Limited team management support

I recommend GlossGenius if you value the design and the appearance of your business and need a simple salon POS that you can manage out of your phone, wherever you are.

Square: The Popular POS System and Credit Card Reader (US, Canada, UK, Australia, Japan)

Square is probably the most well-known credit card machine on this list.

But the famous mobile card reader is just one of the products in the Square family. They also offer an appointment scheduler (read my full review of Square Appointments), an eCommerce platform, and a whole suite of marketing tools that are designed to help local businesses grow.

Square POS is also subscription-free and they earn their money on credit card transactions and their other subscription products that you may want to add after you’ve started using POS and payments.

What I like about Square is its user-friendly and clean interface. Also, their hardware, like the POS terminal, looks nice and clean. And the suite of tools from Square allow you to increase the support as your business grows.

Square Card Readers

Square offers three types of card readers.

1. The Square magstripe card reader is for taking swiped card transactions. It plugs directly into your phone or tablet. The first one is free, and additional mobile card readers cost $10.

2. Square’s second card reader is a sleek small terminal for taking contactless card payments (NFC via Bluetooth). It costs $49, and a Square magstripe reader is included.

3. The Square terminal is an all-in-one card reader. It comes with a touchscreen, allowing you to take payments, access your Square POS system, print receipts, and use all the features of Square’s app. The cost for the terminal is $299.

Square Credit Card Fees and Pricing

There’s no monthly fee, but there is a transaction fee for each sale. 2.6% + 10¢ for swiped or tapped card transactions. 3.5% + 15¢ when the card number is keyed in. Invoices will cost you 2.9% + 30¢ for Invoices Plus users. Free account users pay 3.3% + 30¢ per invoice.

Square hardware costs extra. See above.

Pros

- Easy-to-use mobile app

- Free subscription-only pay credit card transaction fee

- Fully integrated with salon appointments and client data

- Accept payments wherever your client is (for mobile salons)

- Access to Square’s business tools

- Offline mode

Cons

- Limited flexibility and customization options

- Limited availability worldwide

Despite being incredibly feature-rich, it’s clear that Square has made simplicity and ease of use a priority. The card reader and Square terminal’s sleek design and intuitive interface make it an easy-to-use option.

Vagaro: The Feature-Rich, Affordable Salon Software with Integrated Payments (US, Canada, UK, and Australia)

Vagaro is an all-in-one system for salons and spas. The Vagaro system comes with a vast array of features for salons, where POS is only one of the many tools you get.

Apart from the POS system and the credit card reader, Vagaro offers online appointment scheduling, email/SMS marketing, subscription payments, video streaming, website builder, eCommerce, payroll, hardware, and advanced business reporting, just to name a few.

Despite the tremendous number of features you get, Vagaro keeps its pricing very affordable. You can start using Vagaro for as low as $25/month and simply add the features and hardware your business needs.

Vagaro Card Readers

Vagaro offers a mobile card machine and a point-of-sale terminal with contactless payment. You can also run Vagaro in a web browser, on your phone, or on the dedicated pay desk hardware. The pay desk is well-designed and will fit the interior of any beauty salon.

Vagaro Credit Card Fees and Pricing

Vagaro Pro pricing is flexible and modular. The base rate is very affordable, and you can add to it with your own add-ons.

Below is a summary of the Vagaro costs you should expect.

- Free 30-day trial

- Monthly subscription fee: $25 for individuals and $10 for every additional user. Everyone after the 7th user is free.

- Credit card processing fee

- Small merchants (less than $4000/month): 2.75% per swipe, 3.5% + $0.15 per keyed-in transaction. No monthly cost.

- Multiple merchants (less than $4000/month): 2.5% + $0.10 per swipe, 3.5% + $0.15 per keyed-in transaction. No monthly cost.

- Large merchants (more than $4000/month): 2.2% + $0.19 per swipe, 3% + $0.19 per keyed-in transaction. Monthly cost: $10.

Pros

- Many features

- Affordable price

- Integrated payments (inc. recurring subscriptions)

- Client marketplace

Cons

- A moderate learning curve in the beginning

- Pages could load faster

Vagaro is ideal for the cost-conscious salon that wants access to many features while having the simplicity to manage everything in one place.

Even if you are not tech-savvy, you will be able to get marketing campaigns, online booking, and a lot of more advanced features up and running without having to integrate with other tools.

So, if you’re looking for a good credit card processor and an all-in-one business solution for your salon, spa, or health & fitness business, this is a good alternative.

Boulevard: The Up & Coming Integrated POS platform for Larger Salons and Spas

Boulevard offers an integrated payment system through its premium Boulevard Payments platform.

With it, businesses can store cards on file, checkout via the dashboard or iOS Professional App, set up multi-merchant accounts, and utilize the Offset credit card processing feature.

Boulevard’s Offset feature allows you to push the majority of the transactional cost to your clients who use credit cards. Essentially, 3% of any transactional cost will be charged to your clients, and your business takes on only 1%.

While it is technically possible to use third-party POS hardware and credit card processing, it is much more of a challenge to set up and will add more work on the backend when it comes time to reconcile payments and allocate payments for service providers.

Customers check out via an iPad through Boulevard’s Duo iOS app, and can make physical payments via the Boulevard Duo Bluetooth card reader.

Boulevard claims that the Offset feature saves their average customer $9,600 a year, but naturally, that figure will vary depending on the volume of your business and the percentage of your client base that uses cash vs. cards.

Boulevard is a good POS option for larger teams willing to invest heavily in a salon and spa booking and POS system and want a full-featured premium software suite that offers an everything-and-the-kitchen-sink approach.

Boulevard Card Readers

Which card reader can you use with Boulevard?

The POS hardware offered by Boulevard is the Boulevard Duo, an EMV-certified Bluetooth card reader that accepts dip, tap, and swipe transactions and supports Apple Pay and Google Pay.

The Duo reader requires syncing to the Boulevard Duo iPad App, so an iPad must be connected to the reader to take physical payments in-store.

Important Note: If you choose to skip the Duo reader, you can still use the Duo app to collect gratuity, check in clients, and collect digital forms.

Boulevard Credit Card Fees and Pricing

Boulevard is squarely aimed at providing a premium experience for your guests, with a price point to match. For businesses that want to give that luxury experience online and in-store, Boulevard has a range of subscription options.

Here’s an overview of all the costs you can expect with Boulevard:

Credit card fees start at 2.65% + $0.15. They do have volume discounts available and the option to offset a 3% charge to your customers alongside a 1% charge to the business.

Plans range from $175 for the basic Essentials plan to upwards of $500 for the highest tier Enterprise plan – more if you add on extra a la carte features.

Premium Add-ons

Boulevard also offers premium add-ons and integrations that are designed to enhance client communication, make accounting easier, and bolster your business’s marketing efforts.

Other Costs

As with any salon or spa software provider, there are additional costs associated with onboarding and additional hardware or materials.

For instance, an iPad is required to use the Duo card reader and application, which will be an additional cost if you do not already own one.

Boulevard notes in its help center that an iPad Mini is currently not compatible with the Duo app; however, on the POS and Payments page, Boulevard states that any iPad running iOS version 13 or later should be compatible.

Currently, Boulevard’s onboarding fee is listed at $495 (for a single-location business). As with all pricing, this fee is subject to change at Boulevard’s discretion.

If you are coming from another software platform and wish to import your client data, services, products, staff profiles, and appointments, Boulevard offers a couple options:

Full Data Import

If you are able to get admin access to your old platform, you can share that with your Boulevard representative and their team will handle an full data import.

- Priced at $895

- May require admin access to your old salon software platform

- White-glove option

- Offers the smoothest transition to the new system

Excel / CSV Data Import

If you don’t have admin access to your old system or only wish to pull basic information from your previous platform, you can export spreadsheets from that system, and your Boulevard representative can import that data into Boulevard.

- Priced at $295

- It may not require admin access to your old software

- Can bulk upload services, products, and staff profiles

- Requires you to manually enter appointments and appointment notes

View full pricing information on the Boulevard website.

Pros

- Easy-to-use interface

- Excellent online booking

- Client data that you can actually use to boost client retention and sales

- Can integrate with a large number of third party applications

- Integrated payments through Duo

- Memberships, packages, & gift cards (physical & digital)

Cons

- High price-point across all plans

- Essentials plan lacks many of the best features Boulevard offers

- Optional Offset feature may be controversial for some businesses

- Boulevard Professional mobile app is buggy & has low ratings on iOS & Android

- Lacking support for third-party POS card readers

Overall, Boulevard is a rather sophisticated and feature-rich tool for running a beauty and wellness business.

Their everything-and-the-kitchen-sink approach to features and options means you can really dig in with tools that are designed to help you bolster your marketing efforts and aid you in building revenue, tracking progress, and laser-focusing on the reporting that matters to your business.

If you run an established salon or spa with a large team, this tool could provide you with the tools you need to grow your brand and market your best assets online.

Zenoti: The Spa-Oriented Software that Focuses on the Details

Zenoti also offers a first-party integrated payment processing service called Zenoti Payments.

Features include an auto-update feature for card expiration dates, global card access (once a card is stored, your customer can use it at any of your locations without reentering their information), built-in dispute management, auto-reconciliation, and more.

Credit card processing rates listed below are what customers can expect if they decide to sign up for Zenoti Payments:

| Card Present | Card Not Present | |

|---|---|---|

| All cards except Amex | 2.45% + 10c | 2.95% + 10c |

| Amex | 2.95% + 10c | 3.25% + $0.10 |

| Non-Amex Downgrade fee* | 3.35% + $0.35 |

Zenoti claims affordable and competitive credit card processing rates even if you do not choose to use their first-party payment platform. Those charges will be shared below as soon as they are made available by Zenoti.

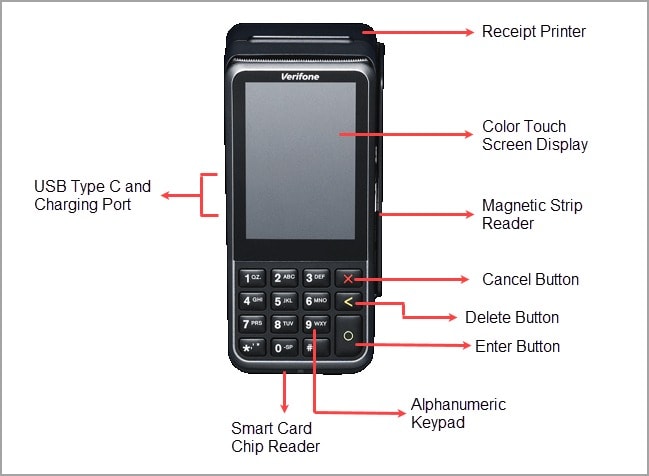

Zenoti Card Readers

Which card reader can you use with Zenoti?

Zenoti offers rather flexible POS and processing options.

You can choose from a range of terminals directly through Zenoti, including the Verifone V400m, e285, and P400 Plus, and Castles S1E and S1F2, or you can use third-party POS hardware solutions such as a Clover POS device. Either way, you can process payments through the Zenoti desktop web app without the need for manual reconciliation at the end of the month.

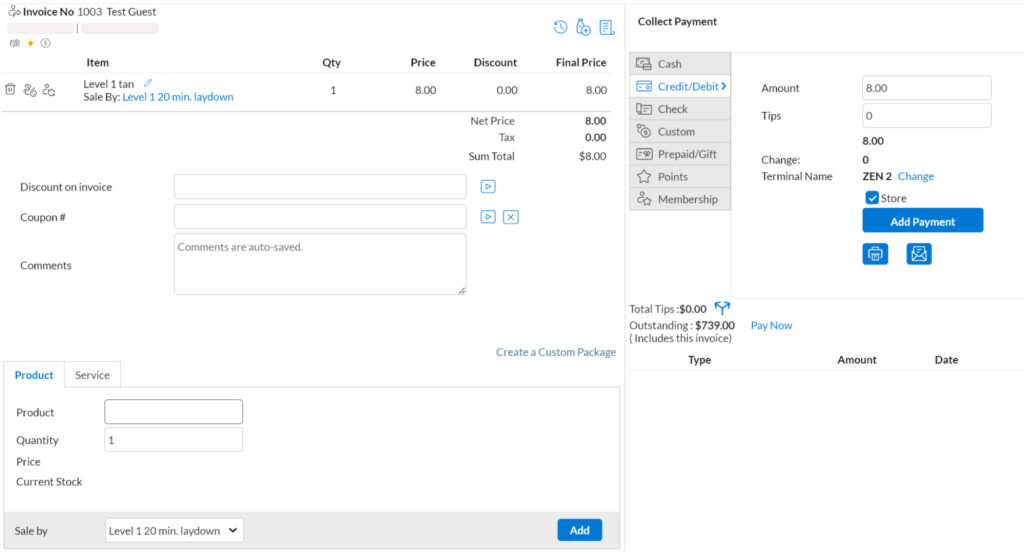

While the POS and card reader options are a plus, the checkout screen in the desktop app itself is a bit of a bellyflop.

Initiating checkout opens a separate browser window where you must process the transaction. This choice baffles me, and it offers a far worse checkout experience than any other software suite I’ve tested.

It should be noted that payments through a Clover terminal or similar third-party POS devices are not done via direct integration. Still, they process the same as standard payments and pose no additional work (outside of a couple extra clicks at checkout).

You can also use an iPad or Android device as a POS terminal by connecting it to your system and using Zenoti’s customer-facing iOS app to allow clients to checkout.

The platform also offers industry-standard features like multi-merchant accounts and direct deposit.

Zenoti Pricing

Zenoti doesn’t offer traditional monthly plan pricing.

In fact, they intentionally don’t list pricing anywhere on their site.

As was the case with Mindbody, you have to submit your contact information via a demo request form on Zenoti’s website and wait to be contacted via phone by one of their sales representatives before you can find out a single detail about Zenoti’s pricing.

I received a call within 24 hours.

In this first touch call, you will be asked for basic details about your business, specify the number of locations you have, and detail your most desired features.

Here’s where we circle back to pricing.

It was on this first call that I first had the chance to ask for a breakdown of pricing plans.

I was told that Zenoti doesn’t offer monthly plans but that I should expect to pay somewhere between $300-$500 per month for a single-location business.

When I asked for clarification, I was told that Zenoti charges by location rather than by plan, and there are individual add-on features that can be added to your monthly fee either a la carte or bundled into an add-on package with other paid add-ons.

Confused yet? I am.

So, to summarize, according to Zenoti’s sales team:

- There is “no plan pricing” listed to base your purchasing decision on

- There is no itemized list of fees to review as a potential business customer

- Pricing is determined on a “per-location basis” rather than by number of employees

- There are also “packages” that include bundles of features you can pay extra for

This is by far the most convoluted and confusing method of salon software pricing I have ever seen.

At the end of the intro call, the sales representative scheduled my demo with one of Zenoti’s account executives and one of their senior sales engineers.

On the demo call, I was shown a presentation with features and benefits before being shown a “custom pricing” slide that listed three “recommended package options.”

Recommended Option #1″

$350 (per month, per location) — includes

- “Salon Core Package”

- ezConnect (two-way SMS feature)

- 7500 marketing emails

- 1000 marketing texts

Recommended Option #2″

$450 (per month, per location) — includes

- Everything in Option #1, plus

- “Marketing Plus Package”

- Custom-branded client-facing mobile app

- ezRepute (review management feature)

“Recommended Option #3”

$500 (per month, per location) — includes

- Option #1, plus

- Smartbot (AI-powered chatbot feature)

Please keep in mind that the options above were described to me as “custom pricing” based on my business needs and do not necessarily reflect the price you will pay.

Zenoti is very secretive about their pricing, and I cannot guarantee that the pricing options they provided to me as a potential customer are the same as the ones they will offer you because Zenoti refuses to commit to standardized, transparent, and well-communicated pricing.

Pros

- Custom online booking

- Can integrate with a large number of third-party applications via an open API

- Integrated payments through Zenoti Payments

- Memberships, packages, gift cards

- Service customizations

- Custom reports

- Two-way texting available (as a paid add-on)

- Help center and Zenoti University (training) available

- Integrated email marketing suite

Cons

- No free trial

- Pricing is not transparent

- Mobile app has low-to-mixed ratings

- You must get on a sales call to learn basic information

- Desktop app is clunky and confusing to navigate

- Complicated menus and settings options

- Requires a 12-month contract

- High starting cost (Minimum $300)

Overall, Zenoti’s desktop experience is serviceable, but it’s ugly, old, and just as unintuitive as its long-standing competitors.

Let’s start with the good first:

Zenoti is mostly feature-complete and offers every feature that its competitors do. From the marketing suite to two-way messaging and even an AI chatbot, it has those elements available to you (usually for an additional fee).

Where it shines above its competitors is with legitimately better reputation management tools that allow business owners to take control of the conversation around their business online and make client satisfaction their top priority.

They also have a decent help center and offer a series of best practice courses on their Zenoti University site. That’s always something we like to see.

However, despite Zenoti being a veteran in the salon software space, they fail at the same weak points as each of their competitors.

This starts with the terrible mobile app experience on offer across both iOS and Android. Reviews are awful across both platforms going back at least five years, indicating a lack of innovation and improvement to one of the core pillars of any booking software.

I wish I could recommend Zenoti more highly, but honestly, they’re barely outdoing Mindbody and offer a broadly similar experience (albeit with a worse UI) to Booker at roughly the same price once you factor in comparable add-on features.

But that’s not to say it isn’t the right choice for any business.

If you absolutely have to have in-depth reputation management features built into your software and can benefit from the marketing tools, customizable reporting functions, and AI tools available from Zenoti, then it may be a good choice for you and your business.

Booker/Mindbody: The Most Established Salon Software With the Best New Client Marketplace (Nearly-Worldwide*)

Booker and Mindbody are compatible with a range of credit card processors, which means you can effectively shop around for the lowest price for a card reader and credit card processing fees – competition is on your side.

Compatible partners include First Data, Bank of America, Payroc, 3C Payments, Worldpay, Sublyme Payments, and more. PayPal can also be accepted online and in-store. A variety of card readers and terminals can be used with Booker to accept payments.

Booker’s tight integration with payment processors will automatically link payments to inventory and update the system inventory accordingly when items are sold.

The platform also offers industry-standard features like multi-merchant accounts and direct deposit.

Booker and Mindbody also offer a first-party integrated payment processing service called Mindbody Payments (available in the US & Canada only).

This service collects payments through your Booker system and organizes payouts that are deposited into your bank account, similar to offerings from competitors such as Boulevard Payments or Mangomint Pay.

Booker Card Readers

Which card reader can you use with Booker?

You can use some third-party POS & card reader devices, such as the Clover Mini terminal, relatively seamlessly with Booker as well.

All currently supported hardware at the time of writing is listed below:

| Desktop/Laptop Hardware | Account version required |

| Star Receipt Printer | Version 1 |

| Star LAN Printer | Version 1 |

| STAR TSP 100 Eco Receipt Printer | Version 1 |

| WisePOS E Reader | Version 2 |

| Stripe Reader M2 Mobile card reader | Version 2 |

| BBPOS Chipper 2x Mobile card reader | Version 2 |

| Clover Mini | Version 2 |

| APG Cash Drawer | Available to both |

| MagTek DynaMag Card Swiper | Available to both |

| MagTek iDynamo Mobile card reader | Available to both |

| Barcode Scanner | Available to both |

Booker / Mindbody Pricing

Booker is a highly competitive salon software option, offering a stable of modern salon management tools and even some AI add-ons with their monthly plans.

The brand has a wide range of monthly plans, starting from $129 for their entry-level “Starter” tier all the way up to $549 for their maxed-out “Ultimate Plus” plan.

Below is a summary of the Booker costs you should expect.

- No free trial

- Monthly subscription fee: starting at $129. Plans range from $129 – $549 per month.

Credit card processing rates listed below are what customers can expect if they decide to sign up for Mindbody Payments:

| Region | Online or on-file: Card-not-present (CNP) | In-person: Card-present (CP) | ACH/DD/SEPA/EFT | Chargeback fees |

| US | 3.5% + .15 USD per transaction | Desktop terminal or mobile card reader: 2.75% per transaction | Not yet available (ACH can be added by contacting support) | $15 |

| Canada | 2.89% + .25 CAD per transaction | 2.39% + .10 CAD per transaction. Interac: .15 CAD per transaction flat fee | Not yet available | $25 |

Pros

- Straightforward pricing

- Enhanced new client acquisition opportunities through the MindBody Explore marketplace

- Integrated payments through Mindbody Payments (US & Canada only)

- AI chatbot feature to help with scheduling (only on Ultimate Plus)

- Integrated email marketing suite (on higher-tier plans)

Cons

- No free trial

- Must commit to a minimum 12-month contract before ever using the software

- Stateside customer support only available to Ultimate and Ultimate Plus plans (outsourced on Starter and Accelerate plans)

- Menu system is a bit clunky and outdated

- Recent mobile app reviews are largely negative

As a piece of software so long in the works, I have to admit that I was left rather unimpressed by its features and options, and I cannot recommend the Booker Mobile app or the Mindbody Business mobile app in good faith due to their lack of reliability and the years-long backlog of neglected reported bugs and glitches.

Moreover, my years of experience with Booker as a salon manager with a large team of stylists track with the poor experiences I’ve read in countless reviews and listened to from dozens of other service professionals.

To that end, both of these pieces software still look, feel, and run the same as they did back in 2016. That is to say, it was outdated and clunky to use then and, tragically, remains that way to this day.

Years of neglect and a lack of consistent innovation make Booker and Mindbody hard to recommend for salon and spa businesses in 2025, but that’s not to say that neither is a good choice for any business.

If the marketing opportunities afforded by the included Mindbody marketplace capabilities could make a major difference in establishing or growing your clientele, and an AI assistant to handle inquiries and help you schedule appointments around the clock could move the needle in filling your books, Booker or Mindbody could be a suitable option for you.

Conclusion

I hope you have found this overview helpful and that you have been able to find out which credit card reader is right for your salon.

If you want to dive even deeper into the salon software options available to you, make sure you check out my comparison of the best salon software for 2025, where I go into even more detail on the salon and spa-specific platforms that are listed in this article.

Quick Recap of The Best Salon Payment Systems 2025